International Payments Bank App

UX Research • Product Design

-

Overview

An international payments application for corporate and institutional banking customers.

-

Client

Mauritius Commercial Bank

-

Role

Senior Product Designer

-

Timeline

10 Month Project

-

Methods

+ Heuristic evaluation + Content audit + User interviews + Affinity mapping + Competitive benchmarking + Best practice research + Personas + Wireframe interactive prototypes + User interface design + Usability test + System Usability Scale

Disclaimer.

In order to comply with my non-disclosure agreement, I have omitted and obfuscated confidential information. All information presented here is my own and does not necessarily reflect the views of my client.

The challenge.

Our product team was asked by the Corporate and Institutional Banking department to find a solution in international payments for their customers. The brief was purposefully vague – the bank was not sure what exactly their customers wanted or needed. All they knew was that it was time to start digitising the entire process of payment for corporates and global businesses.

The process.

We started the project by going on a fact-finding mission by asking customers about their pain points concerning the Internet Banking platform and payments process. The take-away was three-fold – customers needed more flexibility with regards to international payments in foreign currency, they needed a faster way of authorising individual and bulk payments, and they also needed to be able to safely authorise and manage their transactions anytime, anywhere at their convenience.

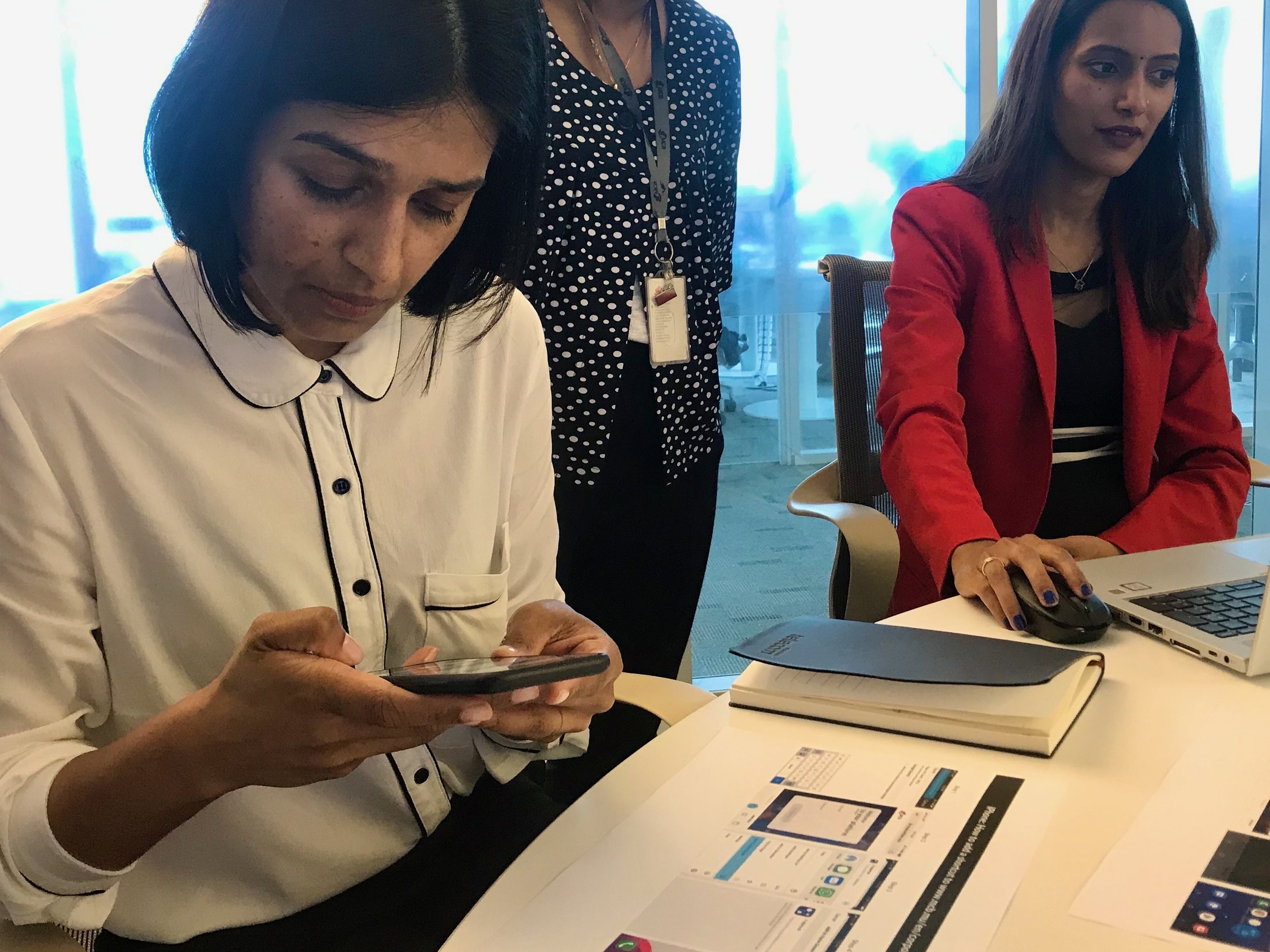

With these findings in hand, we returned to the office to affinity map the key research insights and start white boarding ideas on how to solve them. These I took into design, mocking up low-fidelity wireframes followed by high-fidelity design according to the design system guidelines and a mobile first approach. This was done in-hand with a competitive benchmark analysis and best practice research to understand what our competitors and industry leaders had implemented. Once the high-fidelity designs were critiqued and ready to go, we conducted usability tests with our customers, and asked them to complete System Usability Scale (SUS) questionnaires. This feedback enabled us to edit and iterate on the design, improving the overall functionality before it went into development.

A key part of the process was that our customers were involved in every phase, from research to testing, they were even involved in deciding upon the name of the application – SmartApprove!

What Customers said

“I don’t have time to log in every time on Internet Banking to check if there is a transaction pending authorization.”

— User Research Participant

“I want to see the status of the transactions initiated.”

— User Research Participant

“I need to upload the relevant supporting invoice on the transaction itself so that my finance manager can quickly release the payment.”

— User Research Participant

“Will I be able to access pending transactions from my mobile?”

— User Research Participant

Initiator user persona

Signatory user persona

Product vision statement.

FOR... Corporate and institutional banking customers

WHO... Need a seamless and secure international payment solution that helps them transact while on the go

OUR PRODUCT IS... A responsive web application

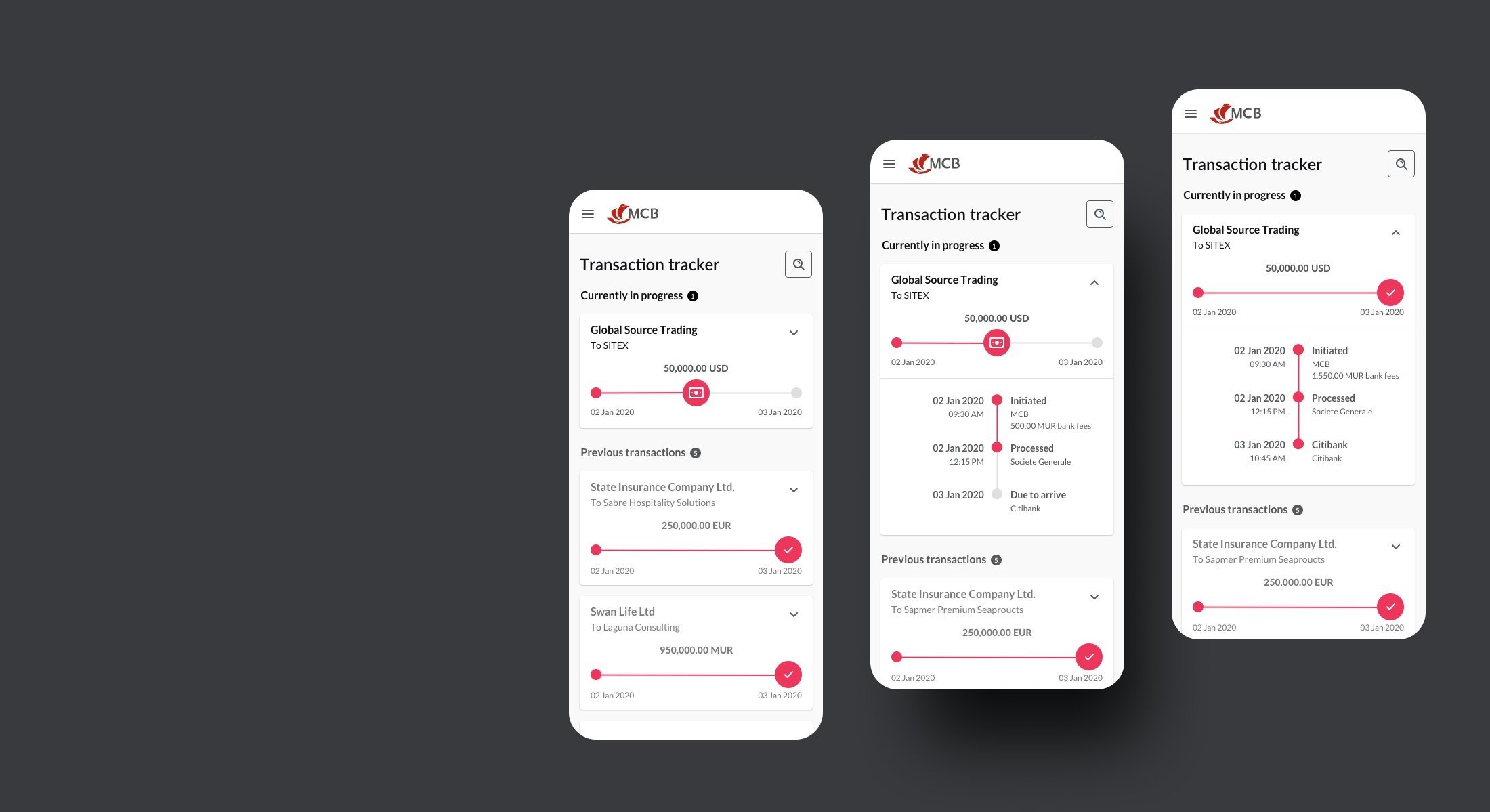

THAT... Provides transparency throughout the payment journey

UNLIKE... Current manual payment solutions

OUR PRODUCT... Is a world-class international payments platform

Testing the app with users

Testing the app with users

System Usability Scale questionnaire

User research findings

Presenting user research results to the bank’s board members

"We are delighted to be able to provide our customers with a service that will help them to track their payments regularly and in real time wherever they are.”

– Sanjeev Hazareesing, Head of Global Transaction Banking

The result.

In February 2020, the SmartApprove responsive web application was launched, catering for cross-border international payments, real-time payment tracking, visibility from payment execution to credit on the beneficiary's account, and SSL Security for fraud prevention.

Before the product’s inception, the rate of customers using the Internet Banking platform was 50%. After the SmartApprove responsive web application was launched, an uptake of 20% was registered, putting the rate of users at 70%.

In hand with this, the team managed to optimise and automate internal processes that support international transactions by 92%, saving the bank time and money.

The application was awarded the Best Adoption of Tools & Governance award of the prestigious IBSI Global FinTech Innovation Awards, in the Payment Hub/Wholesale Payments category.